Key diamond investing characteristics

- Attractive returns – good historical performance with expected solid future price increases (driven by excess demand)

- Low volatility and low correlation (polished diamonds) to main asset classes (inflation hedge characteristics)

- High volatility with attractive trading opportunity (rough diamonds)

Background

The diamond market was dominated by De Beers in the 20th Century, accounting for approximately 80% of the global diamond supply and holding significant stockpiles to control market pricing. In 2001, De Beers was taken private through a significant amount of leverage. To pay down its debt, De Beers sold down its stockpile, keeping diamond prices flat in the early part of this century.

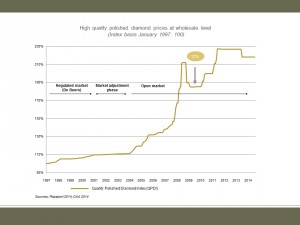

Once their stockpile was depleted, supply and demand forces came to the market and prices began to rise significantly. During the financial crisis (Q4/2008 to Q1/2009), prices of high quality polished diamonds experienced a relatively moderate correction (of approximately 12%) and showed a quick and strong recovery during the course of 2009. From 2013 to 2014, there was a slight pull back in the market (of approximately 4%) due to falling Rupee rates and a tightening of bank lending. Therefore, compared to other assets, prices of high quality polished diamonds were relatively stable.

Over time, especially high quality white polished diamonds of significant size and fancy colored diamonds have shown above-average price increases, and this trend is expected to continue. The following chart shows the development of high quality polished prices since the market deregulation – illustrated by Diamond Asset Advisor’s (DAA) Quality Polished Diamond Index (QPDI):

Continuing the trend of the past decade, the future demand for gem diamonds is forecasted to exceed global supply, which in turn is expected to result in price increases. Most of the existing mines are beyond their peak capacity levels and production has become more expensive as mines move from open pit to underground mining and face stricter environmental regulation. It is generally expected that no new major mines will be developed and opened in the medium term, as the minimum lead time to open a new diamond mine is 7 to 10 years. On the demand side, the US continues to be the largest retail market for polished diamonds, with China and India surpassing Japan in recent years. With the rapid expansion of retail jewelry stores, China is now the second largest market for polished wholesale diamonds.

Investors have experienced volatility not only with listed stocks, but also with tradable forms of precious metals and commodities that were regarded as safe havens following the last recession. Therefore, investors are increasingly looking for attractive, tangible assets with low volatility, low correlation to other main asset classes that offer inflation hedging potential. Investor sensitivity to valuation characteristics has also led to greater appetite for assets, such as physical diamonds, where prices are driven by fundamentals of real supply and demand.

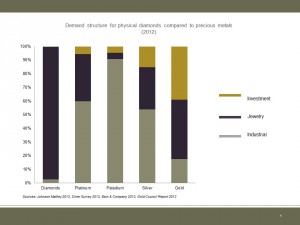

Despite these strong market fundamentals, currently there are no readily accessible pooled investment vehicles meeting the quality and governance requirements of institutional and qualified investors – neither for investments in physical diamonds, nor for financial instruments based on diamond prices. As a result of these hurdles, the investment demand for physical diamonds is virtually non-existent compared to precious metals, as shown in the following graph:

Based on their attractive performance characteristics, diamonds are on their way to becoming recognized as a new attractive alternative investment asset class. First analyst publications (e.g. The Global Diamond Report 2013, Bain & Company) have started to report on diamond investing. As a result, diamonds as an investment opportunity has begun to attract interest from more and more institutional and qualified investors. A number of these investors have already begun to work with qualified partners setting up tailored investment solutions (e.g. through building physical portfolios meeting specific risk-return profiles, establishment of vehicles for diamond retail inventory financing, etc).

High price volatility of rough diamonds: during the global financial crisis, despite continued demand for polished diamonds at the consumer level, rough diamond prices fell by 50% as retailers, wholesalers, and diamond manufacturers sold down existing inventory rather than take the risk of replenishment in an uncertain market. However, 18 months later rough prices more than doubled to exceed pre-crisis levels, as the trade rushed to restock in response to continued consumer demand. It is generally expected that such significant volatility will persist going forward, offering attractive trading opportunities for qualified investors.